claude.ai, developed by Anthropic, has solidified its position as a leading AI conversational model in 2025, competing closely with ChatGPT. Launched in 2023 by former OpenAI researchers, Claude 4 and its specialized Financial Analysis Solution empower over 2 million weekly users across industries like finance, education, and development. With features like real-time data integration, code generation, and enterprise-grade security, Claude excels in delivering safe, context-rich responses. Its partnerships with AWS, Deloitte, and financial data providers like FactSet make it a go-to for digital nomads and professionals. This article explores Claude’s key features, recent advancements, and best practices for leveraging it in 2025’s dynamic digital landscape.

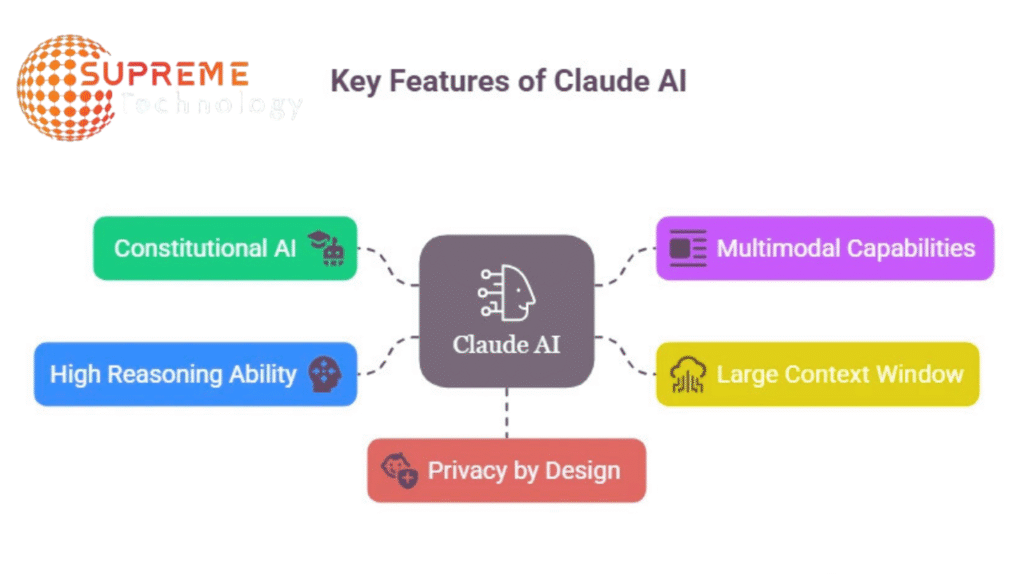

What Makes Claude AI Stand Out?

claude.ai is a generative AI model designed for safety, reasoning, and enterprise use. Its core strengths include:

- Safe and Ethical AI: Prioritizes harmless responses with robust guardrails.

- Advanced Reasoning: Excels in complex tasks like financial modeling and code generation.

- Data Integration: Connects to platforms like Snowflake and FactSet for real-time insights.

- Enterprise Focus: Offers tailored solutions with high security and compliance standards.

- Multimodal Capabilities: Processes text, images, and audio for versatile workflows.

Key Features and Developments for Claude AI in 2025

Drawing from recent updates, here are the top advancements in claude.ai for 2025:

1. Financial Analysis Solution

- Description: Launched in July 2025, Claude for Financial Services integrates market feeds and internal data from platforms like Databricks, Snowflake, and FactSet into a unified interface. It supports Monte Carlo simulations, compliance automation, and investment memo generation, with a 20% productivity gain reported by clients like NBIM.

- Key Benefits: Speeds up due diligence; ensures auditable outputs.

- Best For: Financial analysts and portfolio managers.

- Implementation: Deploy via AWS Marketplace; use pre-built MCP connectors for data access.

2. Claude Code Enhancements

- Description: claude.ai Code, processing 195 million lines weekly, generates and debugs Python, JavaScript, and more. In 2025, it passed 5/7 levels in the Financial Modeling World Cup with 83% accuracy on complex Excel tasks, aiding trading and risk modeling.

- Key Benefits: Automates coding; modernizes legacy systems.

- Best For: Developers and analysts automating workflows.

- Implementation: Enable Claude Code in the workspace; use for custom financial models.

3. Expanded Context Window

- Description: Claude.ai 4’s 200k-token context window, expanded in 2025, handles large documents like 10-Ks or earnings transcripts, enabling comprehensive analysis without rate limits. It supports portfolio monitoring and cross-platform data stitching.

- Key Benefits: Processes vast datasets; reduces manual research time.

- Best For: Hedge funds and banks conducting due diligence.

- Implementation: Upload documents via the Claude interface; query for summaries or analytics.

4. Enterprise-Grade Security

- Description: Claude.aiensures data privacy by not using inputs for training. It offers Compliance Requirements Generator (CRaiG) and audit trails, meeting GDPR and financial regulations. Partnerships with Deloitte and KPMG aid secure adoption.

- Key Benefits: Protects sensitive data; ensures regulatory compliance.

- Best For: Enterprises with strict data governance needs.

- Implementation: Deploy with consultancy support; configure CRaiG for compliance.

5. Real-Time Data and MCP Connectors

- Description: Claude’s 2025 MCP connectors link to S&P Global, Morningstar, and PitchBook, providing real-time market data and private intelligence. This powers competitive benchmarking and ESG analysis with verifiable sources.

- Key Benefits: Enhances decision-making; reduces data fragmentation.

- Best For: Analysts needing unified data access.

- Implementation: Activate connectors in Claude’s dashboard; verify data via hyperlinks.

Warnings and Considerations

- Vendor Lock-In Risk: Reliance on Anthropic’s ecosystem may limit flexibility. Assess integration with legacy systems to avoid dependency.

- Learning Curve: Complex features like MCP connectors require training. Use Anthropic’s six-week onboarding program.

- Hallucination Risk: While improved, Claude may produce inaccuracies. Verify outputs using source hyperlinks.

- Cost: Enterprise plans are pricier than consumer options; pricing is quote-based. Compare with alternatives like ChatGPT for cost-effectiveness.

- Limited Consumer Features: Claude avoids video/image generation, focusing on enterprise tasks. Use competitors for creative needs.

How to Leverage Claude AI Effectively in 2025

Maximize Claude’s potential with these strategies:

- Digital Nomads: Use Claude’s cloud-based interface for remote financial analysis; access via mobile for on-the-go insights.

- Analysts: Leverage MCP connectors for real-time market data; run Monte Carlo simulations for risk assessment.

- Developers: Use Claude Code for automating Excel tasks or building trading algorithms; test with sample datasets.

- Enterprises: Deploy with Deloitte/KPMG support for compliance; integrate with Snowflake for unified data.

- Educators: Use Claude’s narrative-driven summaries to teach financial concepts; query for simplified explanations.

Conclusion

In 2025, Claude AI, powered by Anthropic, is a transformative tool for financial professionals, developers, and digital nomads, with over 2 million weekly users. Its Financial Analysis Solution, Claude Code, and MCP connectors streamline complex workflows, from market analysis to compliance automation. Despite challenges like a learning curve and vendor lock-in risks, Claude’s enterprise-grade security, real-time data integration, and partnerships with AWS and Deloitte make it a powerhouse. By leveraging its context window, verifying outputs, and utilizing consultancy support, users can harness Claude to excel in 2025’s data-driven, location-independent digital ecosystem.