Betterment, a pioneer in the robo-advisor space, continues to redefine digital wealth management in 2025 with its low-cost, automated investing and comprehensive financial planning tools. Managing over $56 billion in assets for 900,000+ customers, blends cutting-edge technology with access to certified financial planners (CFPs) to serve beginners and seasoned investors alike. Recent acquisitions and new offerings, like solo 401(k)s and expanded portfolio options, solidify its leadership in the fintech industry. This article explores key features, recent developments, and its role in empowering wealth-building in 2025.

What Makes Betterment Stand Out?

Betterment’s blend of automation and human guidance sets it apart as a top robo-advisor. Its core strengths include:

- Low-Cost Investing: Commission-free trading and low management fees (0.25% for Digital, 0.65% for Premium).

- Goal-Based Planning: Tailored portfolios for retirement, emergency funds, and wealth-building.

- Tax Optimization: Features like tax-loss harvesting and tax-coordinated portfolios minimize tax liabilities.

- Flexible Portfolios: Offers Core, Socially Responsible Investing (SRI), Innovative Technology, and crypto portfolios.

- Fiduciary Duty: As a fiduciary, Betterment prioritizes clients’ best interests.

Key Features and Developments of Betterment in 2025

Based on recent updates from sources like NerdWallet, Forbes, and Betterment’s official site, here are the top features and advancements of in 2025:

1. Enhanced Portfolio Management

- Description: Betterment offers automated portfolio management with diversified ETF portfolios, including Core, Value Tilt, SRI (Broad, Social, Climate Impact), and Innovative Technology. In February 2025, Betterment updated allocations, increasing U.S. stock and bond exposure while reducing emerging market assets. The Innovative Technology portfolio added an AI and biotech-focused ETF for greater diversification.

- Key Benefits: Automated rebalancing and fractional shares ensure full investment and tax efficiency.

- Best For: Hands-off investors seeking diversified, low-cost portfolios.

- Implementation: Complete the goal-setting questionnaire in the app; enable auto-rebalancing for tax efficiency.

2. Betterment Premium with CFP Access

- Description: For accounts with $100,000+, Betterment Premium (0.65% annual fee) offers unlimited access to a team of eight CFPs for comprehensive planning, including retirement, estate coordination, and tax strategies like backdoor Roth IRA conversions. Premium clients also receive a 0.25% APY boost on Cash Reserve accounts (4% base rate).

- Key Benefits: Personalized advice at a lower cost than traditional advisors like Empower.

- Best For: High-net-worth users needing tailored financial guidance.

- Implementation: Upgrade to Premium via the app; schedule CFP consultations for complex planning.

3. Solo 401(k)s and Retirement Solutions

- Description: Launched in February 2025, Betterment Advisor Solutions introduced solo 401(k)s for self-employed clients, offering higher contribution limits (up to $69,000 in 2025) than SEP or SIMPLE IRAs. Betterment also supports traditional, Roth, and SEP IRAs, with automated rebalancing and tax-loss harvesting.

- Key Benefits: Maximizes retirement savings; integrates with payroll for seamless management.

- Best For: Self-employed individuals and small business owners.

- Implementation: Set up via at Work; consult CFPs for contribution strategies.

4. Cash Management and High-Yield Accounts

- Description: Betterment’s Cash Reserve offers up to $2M FDIC insurance for individual accounts ($4M for joint accounts) with a 4% APY (4.25% for Premium). The Checking account, provided by nbkc bank, offers no-fee transactions and $250,000 FDIC insurance per depositor. These accounts integrate with investing goals for seamless fund transfers.

- Key Benefits: High yields and liquidity for emergency funds or short-term savings.

- Best For: Users consolidating cash and investment management.

- Implementation: Link Cash Reserve to investment accounts; use the app for goal-based transfers.

5. Acquisitions and Advisor Solutions

- Description: In February 2025, acquired Ellevest’s automated investing accounts, expanding its client base. The rebranded Advisor Solutions (formerly Betterment for Advisors) added features like custom model portfolios with single stocks, enhanced account aggregation, and a new Advisor Exchange video series hosted by Tom Moore. The platform now supports RIAs with no AUM minimum.

- Key Benefits: Empowers advisors with tech-driven tools; enhances client outcomes.

- Best For: RIAs and advisors seeking scalable, tech-forward solutions.

- Implementation: Book a demo at https://betterment.com; use client tours for onboarding.

Warnings and Considerations

- No Self-Directed Trading: Betterment lacks DIY trading for individual stocks or options, unlike Wealthfront or Vanguard.

- Premium Plan Costs: The $100,000 minimum and 0.65% fee for Premium may deter smaller investors. The Digital plan (0.25% or $4/month) is more accessible.

- Limited Educational Resources: Betterment’s articles and tools lag behind competitors like Fidelity in depth.

- Regional Restrictions: Some features may be unavailable in censored regions; use a VPN like NordVPN (https://nordvpn.com) for secure access.

- Market Risks: Tax-loss harvesting and crypto investments carry market and regulatory risks. Consult CFPs for risk management.

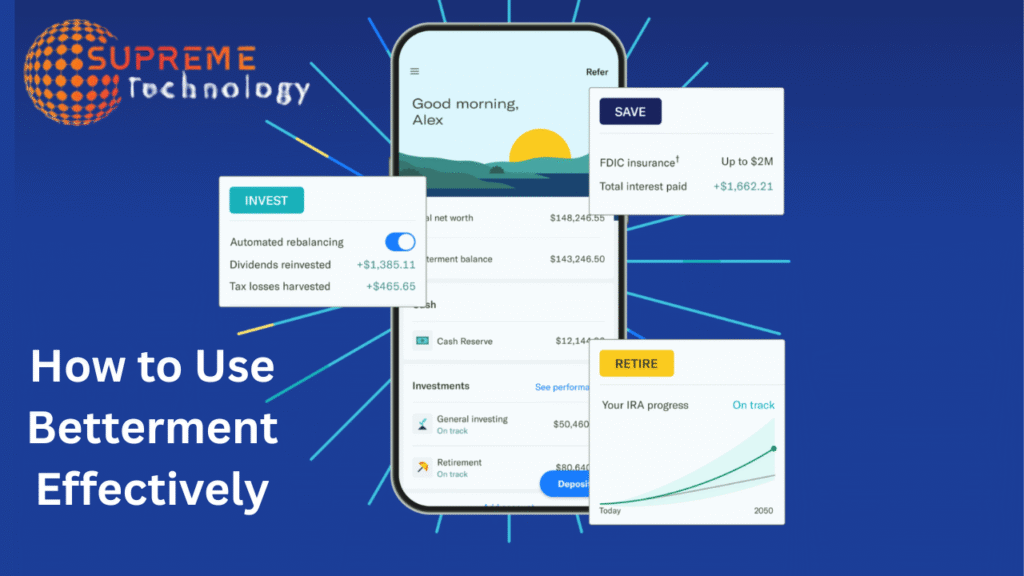

How to Use Betterment Effectively in 2025

Leverage Betterment based on your needs:

- Beginners: Start with the Digital plan ($10 minimum); use goal-setting tools for emergency funds or retirement.

- High-Net-Worth Investors: Opt for Premium for CFP guidance on complex strategies like Roth conversions.

- Self-Employed: Set up a solo 401(k) via at Work; maximize contributions for tax benefits.

- Advisors: Use Betterment Advisor Solutions for custom portfolios and client onboarding; explore the Advisor Exchange series.

- Socially Conscious Investors: Choose SRI portfolios for values-based investing.

Conclusion

In 2025, Betterment remains a leading robo-advisor, managing over $56 billion with a focus on low-cost, automated investing and personalized financial planning. With new features like solo 401(k)s, the Ellevest acquisition, and portfolio updates emphasizing U.S. equities and AI-driven tech, caters to diverse investors and advisors. Despite limitations in self-directed trading and educational content, its tax-efficient strategies, high-yield cash accounts, and fiduciary commitment make it a top choice. By selecting the right plan and leveraging CFP guidance, users can optimize their financial goals in 2025’s dynamic market.